Automotive

Polish Automotive sector ranks second in terms of manufacturing output is a solid backbone of country’s economy. Thanks to flexibility and creativity of Polish workers, healthy cost structures and strong demand for vehicles and parts manufactured in Poland the industry has emerged from the turbulent times almost intact. Three major passenger car OEMs (plus new VW plant under construction), several bus producers and hundreds of Tier 1 and 2 manufacturers make a solid industrial base. Worth to know that every sixth zloty in Polish export is generated by the automotive sector.

The numbers depicted above are not a result of coincidence or good luck. Besides an excellent cost-to-quality ratio Poland offers the biggest pool of talented people easy to reach. 1,5 million students spread across several major university hubs, young professionals accustomed to the highest quality and efficiency standards create a strong asset for new investments. Short proximity to major European motor vehicle markets, attractive incentives system, stable and predictable economy make Poland a place worth considering as an investment location.

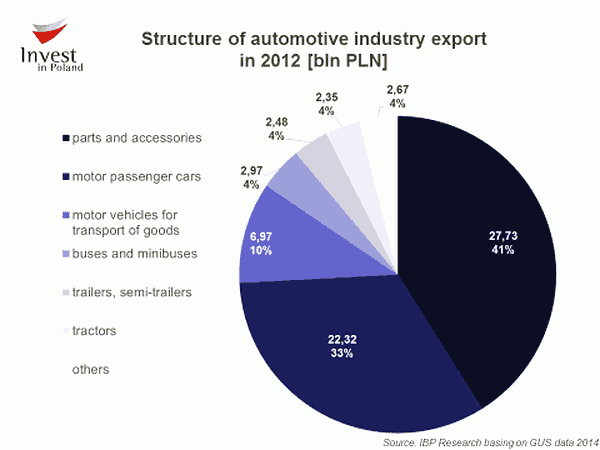

Out of 40 car and engine plants located in Central Eastern Europe (CEE) 16 are based in Poland. They sell abroad of vehicles, parts and accessories thereof accounted for about 11% of the country’s total exports in 2013. Almost 80% of Polish automotive exports is directed to the EU markets. According to information from Central Statistical Office for 2013, sector constitutes more than 9% of Polish manufacturing production and gives jobs to around 160.000 of employees.

The numbers depicted above are not a result of coincidence or good luck. Besides an excellent cost-to-quality ratio Poland offers the biggest pool of talented people easy to reach. 1,5 million students spread across several major university hubs, young professionals accustomed to the highest quality and efficiency standards create a strong asset for new investments. Short proximity to major European motor vehicle markets, attractive incentives system, stable and predictable economy make Poland a place worth considering as an investment location.

Out of 40 car and engine plants located in Central Eastern Europe (CEE) 16 are based in Poland. They sell abroad of vehicles, parts and accessories thereof accounted for about 11% of the country’s total exports in 2013. Almost 80% of Polish automotive exports is directed to the EU markets. According to information from Central Statistical Office for 2013, sector constitutes more than 9% of Polish manufacturing production and gives jobs to around 160.000 of employees.

Passenger cars production

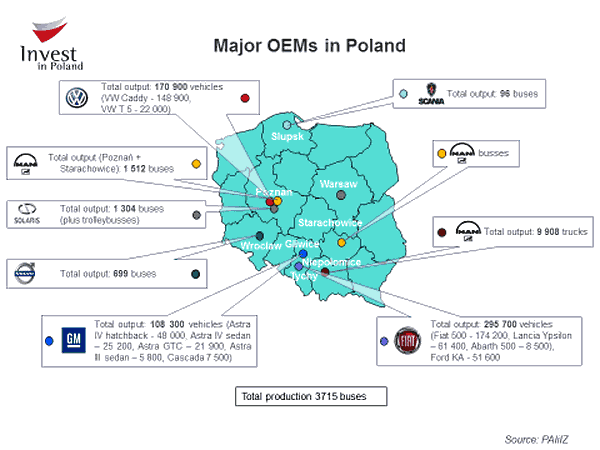

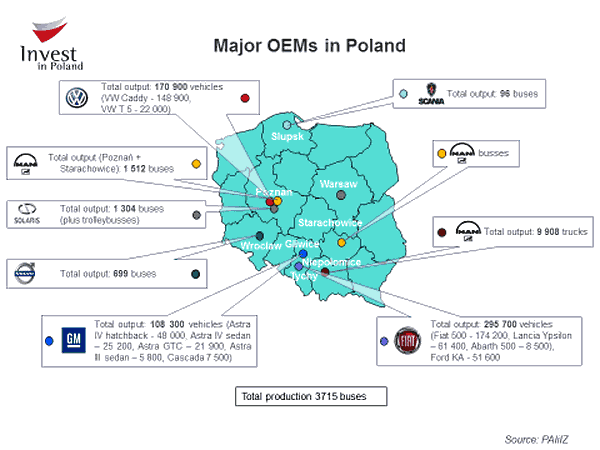

According to the PZPM data in 2013 575,117 thousand vehicles were produced in Poland, 9,55% less than in 2012. Fiat Tychy plant manufactured 295.700 thousand units (down by 15.2% in comparison to previous year). The company is followed by Poznań based Volkswagen produced 170 875 thousand cars (up 5,52%), and GM located in Gliwice manufactured 108 542 thousand units (production down by 13,4%).

In 2013 the size of production amounted to around EUR 26 billion, increasing by 6,6% y/y. BMI believes that the domestic sales of Polish automotive industry will be able to achieve average annual growth rate of around 4% in years 2014-2016. Optimistic forecast for vehicle production in Poland is based on strong macroeconomic fundamentals which should result in accelerating GDP growth rates in years 2014-2016.

In 2013 the size of production amounted to around EUR 26 billion, increasing by 6,6% y/y. BMI believes that the domestic sales of Polish automotive industry will be able to achieve average annual growth rate of around 4% in years 2014-2016. Optimistic forecast for vehicle production in Poland is based on strong macroeconomic fundamentals which should result in accelerating GDP growth rates in years 2014-2016.

Bus production

There are many operating bus manufacturers in Poland: of the leading manufacturers of buses in the EU. According to data compiled by the JMK automotive research company, in Poland in 2013 more than 3715 buses were produced, which is about 4,3% units more than in 2012. In 2013, the export amounted to 3302 buses.

Polish bus manufacturers offers a variety types of engines, including traditional diesel ones, hybrids, CNG and electric engines (e.g. Solaris).

Polish bus manufacturers offers a variety types of engines, including traditional diesel ones, hybrids, CNG and electric engines (e.g. Solaris).

Supply chain

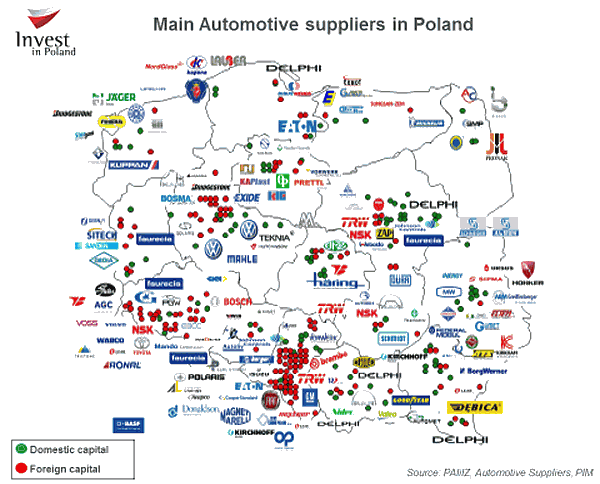

The product portfolio of Polish Tier 1 and 2 suppliers is very wide. It covers among others: powertrain units (two Toyota plants, Volkswagen Motor Polska, Fiat Powertrain and GMMP), steering systems (Nexteer Automotive, TRW, Delphi, Mando Corporation), lightning systems (Valeo, Automotive Lightning), cooling systems (Delphi, Valeo, Hutchinson), car body and underbody structures (Gedia, Kirchoff), tyres (Michelin, Bridgestone, Goodyear), car glasses (Pilkington, Saint-Gobain Sekurit, PGW), interior parts (Boshoku, Faurecia), seating systems (Faurecia, Sitech, Johnson Controls, Lear Corporation), safety systems (TRW, Autoliv).

Approximately 500 companies in Poland have ISO/TS 16949 certificate confirming quality management system required by automotive OEMs. Several R&D development centres operating in Poland is a testimonial of high technical potential of Polish staff. The largest R&D centre in Poland was created in Cracow by Delphi company (over 1000 engineers). Other R&D establishments includes: Tenneco, TRW, Valeo, Faurecia, Wabco, Eaton or Mbtech operations.

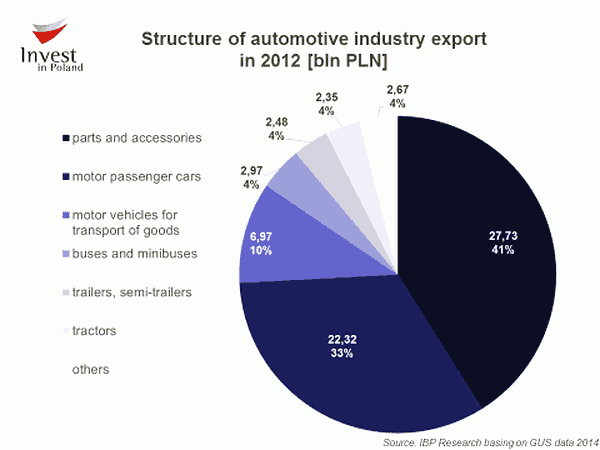

Export

Export competitiveness is still strong as despite dynamic growth over the past few years.

According to the PZPM data in 2013 98,7% of Polish passenger and light commercial car production is exported.

Value of the automotive export reached the level of EUR 17.9 billion (+1% y/y). In 2013 for 575 117 passenger and light commercial cars produced in Poland, 567 604 vehicles was assigned for export. 80% of vehicles was sold to European Union (14,4 bln EUR). Export beside EU increased by more than 9% (3,5 bln EUR). Vehicles are mostly exported to: Germany (30%), United Kingdom (8,7%), Italy (8,5%), France (5,8%), Czech Republic (5,6%) and Spain (4,0%).

According to the PZPM data in 2013 98,7% of Polish passenger and light commercial car production is exported.

Value of the automotive export reached the level of EUR 17.9 billion (+1% y/y). In 2013 for 575 117 passenger and light commercial cars produced in Poland, 567 604 vehicles was assigned for export. 80% of vehicles was sold to European Union (14,4 bln EUR). Export beside EU increased by more than 9% (3,5 bln EUR). Vehicles are mostly exported to: Germany (30%), United Kingdom (8,7%), Italy (8,5%), France (5,8%), Czech Republic (5,6%) and Spain (4,0%).

Investments

Number of large multinational companies have made large investments over a number of years, attracted by government incentives, the competitive cost and highly qualified and motivated workforce and Poland’s attractive location in the heart of Europe. The existence of Special Economic Zones has also been an important factor influencing the location decision of foreign investors.

What is more, Poland has been constantly regarded as one of the top investment destination for automotive industry. Suffice to mention the spectacular investments decisions in 2014 made by Volkswagen in Września, or GM in Tychy. Furthermore, the country's human capital is well-skilled, as well as efficient, and Poland is geographically well-placed will help to develop of the sector. These factors should also facilitate investments in the country, boosting the automotive output in the long run.

The rationale for the development of automotive industry in Poland

Abundance of qualified workforce across several major Polish automotive regions;

Easy and prompt access to major OEMs and suppliers in CEE and Western Europe;

Dozens of potential locations which offers unrivalled in CEE conditions for new production and R&D establishments;

High growth potential for sales of new cars in Poland;

Attractive system of investment incentives including cash grants and tax holidays.

What is more, Poland has been constantly regarded as one of the top investment destination for automotive industry. Suffice to mention the spectacular investments decisions in 2014 made by Volkswagen in Września, or GM in Tychy. Furthermore, the country's human capital is well-skilled, as well as efficient, and Poland is geographically well-placed will help to develop of the sector. These factors should also facilitate investments in the country, boosting the automotive output in the long run.

The rationale for the development of automotive industry in Poland

Abundance of qualified workforce across several major Polish automotive regions;

Easy and prompt access to major OEMs and suppliers in CEE and Western Europe;

Dozens of potential locations which offers unrivalled in CEE conditions for new production and R&D establishments;

High growth potential for sales of new cars in Poland;

Attractive system of investment incentives including cash grants and tax holidays.

Incentives available for automotive projects

Automotive industry is considered as a priority sector for the Polish government and it is included in a short list of industries that may apply for direct governmental cash grants.

exemption from Corporate Income Tax in 14 Special Economic Zones;

exemption from real estate tax according to respective resolutions in local communes;

support offered by local labour offices for hiring unemployed persons.

For more details regarding public aid available in Poland please consult the following PAIiIZ webpage:

www.paiz.gov.pl/index/?id=7c4121d27bf970f00f1dfdcee8f43a5d

Automotive industry related institutions

Polska Izba Motoryzacji

Grażyny 13/15 Street

02-548 Warszawa

Phone: +48 22 646 08 18, +48 22 440 84 59

e-mail: sekretariat@pim.org.pl

www.pim.pl

Polski Związek Przemysłu Motoryzacyjnego

BTC Office Centre

Al. Niepodległości 69 Street

02-626 Warszawa

Phone: +48 22 322 71 98

www.pzpm.org.pl

Instytut Badań Rynku Motoryzacyjnego SAMAR

Wąwozowa 11/4 Street

02-796 Warszawa Poland

Phone: +48 228 597 552, +48 228 597 553

e-mail: contact@samar.pl

www.samar.pl

Stowarzyszenie Dystrybutorów i Producentów Części Motoryzacyjnych

Za Dębami 3 Street

05-075 Warszawa

Phone/Fax.: +48 22 773 00 18

e-mail: info@sdcm.pl

www.sdcm.pl; www.r2rc.pl

AutomotiveSuppliers.pl s.c.

Staniewicka 14 Street

03-310 Warszawa

Phone: +48 22 215 05 05, +48 22 435 88 22

e-mail: review@automotivesuppliers.pl

www.AutomotiveSuppliers.pl

Publications:

www.pzpm.org.pl/en/Publications/Reports/PZPM-Automotive-Industry-Report-2014

exemption from Corporate Income Tax in 14 Special Economic Zones;

exemption from real estate tax according to respective resolutions in local communes;

support offered by local labour offices for hiring unemployed persons.

For more details regarding public aid available in Poland please consult the following PAIiIZ webpage:

www.paiz.gov.pl/index/?id=7c4121d27bf970f00f1dfdcee8f43a5d

Automotive industry related institutions

Polska Izba Motoryzacji

Grażyny 13/15 Street

02-548 Warszawa

Phone: +48 22 646 08 18, +48 22 440 84 59

e-mail: sekretariat@pim.org.pl

www.pim.pl

Polski Związek Przemysłu Motoryzacyjnego

BTC Office Centre

Al. Niepodległości 69 Street

02-626 Warszawa

Phone: +48 22 322 71 98

www.pzpm.org.pl

Instytut Badań Rynku Motoryzacyjnego SAMAR

Wąwozowa 11/4 Street

02-796 Warszawa Poland

Phone: +48 228 597 552, +48 228 597 553

e-mail: contact@samar.pl

www.samar.pl

Stowarzyszenie Dystrybutorów i Producentów Części Motoryzacyjnych

Za Dębami 3 Street

05-075 Warszawa

Phone/Fax.: +48 22 773 00 18

e-mail: info@sdcm.pl

www.sdcm.pl; www.r2rc.pl

AutomotiveSuppliers.pl s.c.

Staniewicka 14 Street

03-310 Warszawa

Phone: +48 22 215 05 05, +48 22 435 88 22

e-mail: review@automotivesuppliers.pl

www.AutomotiveSuppliers.pl

Publications:

www.pzpm.org.pl/en/Publications/Reports/PZPM-Automotive-Industry-Report-2014